Ultimate Mississippi labor laws guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Mississippi Labor Laws FAQ | |

| Mississippi minimum wage | $7.25 |

| Mississippi overtime laws | 1.5 times rate for over 40 hours per week $10.875 for minimum wage workers |

| Mississippi break laws | None required |

The first segment we’ll cover in this text is the hourly minimum wage requirement in the state of Mississippi.

The minimum wage requirement is different for non-tipped and tipped employees.

Moreover, certain occupations are exempt from this requirement, and we will cover all instances in the following segments.

Employees who work up to 40 hours per week are paid at least the minimum wage, while employees who work over 40 hours a week get paid at a higher rate.

This is regulated by the Fair Labor Standards Act, and the state of Mississippi follows the federal minimum wage regulation.

Let's see what Mississippi employees are entitled to, in terms of fair and adequate compensation for their work, on an hourly basis.

| Mississippi Minimum Wage Laws (hourly) | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | $2.13 | $7.25 |

In the state of Mississippi, no state law sets the minimum hourly wage.

Therefore, the minimum wage requirement is the same as the federal law states — at least $7.25 per hour worked.

The minimum wage for Mississippi employees will increase correspondingly when the federal minimum wage rises.

It is important to mention that it is illegal for employers to offer a lower hourly rate to all employees who are non-exempt from the rule.

However, there are some exemptions and exceptions to the minimum wage rule — for example, for tipped occupations.

Read the following segments to ensure you are fully aware of which situations and positions are exempt from the minimum wage rule, whether you are an employer or an employee.

Certain professions, especially the ones in the hospitality industry, are commonly and closely tied to tips.

According to the Internal Revenue Service (IRS), tipped minimum wage refers to certain sums of money that customers freely provide to tipped employees as a recognition for their service and attitude.

Employees must regularly receive such gratuities (mostly in cash) to count as tipped employees — e.g., servers, bartenders, waiters, delivery people, etc.

The minimum wage for tipped employees in Mississippi is $2.13 per hour.

However, the tipped minimum wage rate is applicable only if the sum of the basis ($2.13) and the earned tips amounts to at least $7.25 (regular minimum wage.) If the sum is lower, the law states it is up to their employers to make up the difference.

As the state of Mississippi follows the federal wage rules, under the FLSA, tip pooling is permitted and may even be required by an employer.

This practice would mean having all the collected tips during one shift redistributed amongst all the employees, even the ones who do not regularly receive cash gratuities (chefs, assistant chefs, prep cooks, line cooks, dishwashers, etc.).

Just as tipped employees are exempt from the minimum wage requirement, there are other instances of exempt occupations.

Since Mississippi has no wage laws, the FLSA declaration specifies certain occupations as exemptions from the minimum wage requirements.

Let's now look at some occupations considered exempt from the standard minimum wage requirements in Mississippi:

We have already mentioned that the state of Mississippi does not have its own minimum wage laws. That further implies the state does not address any subminimum wage requirements, which means the federal rules apply again.

Subminimum wage usually applies to the following categories of employees:

The term “minors” refers to young workers who are under the age of 18.

Because of the federal law application, Mississippi employers are not allowed to pay an hourly rate lower than the standard hourly rate to any of the abovementioned employees.

This means that subminimum and minimum wages are the same in Mississippi based on the federal minimum wage of $7.25 per hour.

However, federal law allows employers to pay youth employees under 20 years of age a minimum wage of $4.25 per hour for the first 90 calendar days of employment.

Now let's see what are the state requirements for Mississippi employers when it comes to the frequency of payments.

Under Mississippi law, employers are required to provide payment once every two weeks or twice a month.

So, the payroll periods operate on a semi-monthly basis or a bi-weekly basis.

In other words, employers must compensate their employees no later than 14 days after a certain pay period ends.

This rule does not cover private employers and therefore applies only to:

Mississippi employers are required to provide an itemized statement of deductions for each pay period.

However, the state does not have any other specific laws regarding deductions.

That means there are no restrictions on employers deducting any amounts from their employees' paychecks for the following reasons:

The federal law also states that employers can make deductions for the above reasons only if said deductions do not cause an employee to earn less than the federal minimum wage in a certain payroll period.

According to federal and Mississippi state law, any number of hours exceeding 40 per week counts as overtime. Employees who work at least 40 hours per week are considered full-time employees.

Non-exempt employees who work more than 40 hours per week are entitled to 1.5 times their regular hourly rate.

For minimum wage employees (who earn $7.25 per hour), that currently translates to $10.875 per hour and is applicable to all non-exempt employees.

Some exemptions exist when it comes to overtime regulations. If an employee is exempt from overtime rules, the employer is not required to compensate them at a 1.5 rate.

The following section will deal with exemptions from overtime, so you can check out if you or your employees are eligible for overtime compensation in Mississippi.

According to the federal overtime rules, which the state of Mississippi abides by, specific categories of employees are not protected by the overtime law.

One type of exempt employees are “white-collar employees” paid on a salary basis. Examples of white-collar employees include individuals who work at jobs related to government, academia, business, accounting, executive management, public relations, healthcare, and more.

To be exempt from the minimum wage and overtime requirements, “white collar employees” must pass 3 tests:

Moreover, these employees must be compensated at a standard salary level, which equals at least $884 per week ($43,888 per year).

The federal law also specifies another group of exempt employees, known as “highly compensated employees.”

These employees earn at least $132,964 per year on a salaried basis. This threshold is set to increase to $151,164 per year on January 1, 2025.

The $884 standard salary threshold is set to increase to $1,128 per week on January 1, 2025, and it will further increase on July 1, 2027, and every 3 years after that to keep up with inflation rates.

Regarding overtime exemptions, federal law expands its restrictions to some other, more specific occupations.

The above-mentioned list of exemptions to the minimum wage applies to overtime as well, so here are some employee categories that are exempt from overtime:

Employers in the state of Mississippi are not legally required to provide a meal or a rest break to their employees.

However, employers can choose to offer both meal and rest breaks. In those cases, federal rules apply.

Therefore, if an employer does offer either type of break, the law states that:

It is important to note that federal law distinguishes between the break periods mentioned above and compensable waiting or on-call times.

On-call times are when employees remain at their workplace while waiting for a “call” to get back to work (e.g., customer support agents).

In the State of Mississippi, breastfeeding mothers enjoy both federal and state protections while working.

According to Mississippi's breastfeeding law, employers must give mothers a reasonable break to pump milk at work.

Moreover, breastfeeding mothers are protected by the federal PUMP Act, which requires employers to provide a room for pumping milk, which meets the following conditions:

Breastfeeding mothers can exercise these rights for up to 1 year after the child’s birth.

Regarding leave requirements in Mississippi, the law regulates which types of leave Mississippi employers are required to offer and provide and what happens in terms of compensation during an employee's leave.

The main question is the reason for the leave — why is an employee asking for a leave of absence? The law clearly regulates that employees should not suffer any negative consequences upon their return to work for the required types of leave.

Here are the State of Mississippi's rules and regulations regarding required and non-required leave.

Family and medical leave — the Family and Medical Leave Act (FMLA) states that all employees are eligible to use 12 weeks of unpaid, job-protected work absence in one year, for many household and medicinal-related reasons.

The reasons include the following:

An employee must work for the employer for at least a year and at least 1,250 work hours (in one year) to be eligible. Note that this is applicable only to employers with over 50 employees.

Additionally, in an effort to protect the families of the Armed Services, Congress amended the FMLA in 2008.

Since then, employers have also been required to provide up to 26 weeks of unpaid leave if an employee needs to take care of a member of the Armed Forces who:

This is applicable only if said member is the employee's spouse, parent, child, or next of kin.

Sick leave — under Mississippi state law, private sector employers are not required to offer paid or unpaid sick days.

However, if an employer decides to provide sick leave as part of the employment, they must abide by those rules.

Holiday leave — public sector employers in Mississippi are legally required to offer either paid or unpaid leave for the period of any public holiday and celebrations related to it.

On the other hand, private employers are not required to offer this type of leave.

Vacation leave — employers are not required to provide vacation leave.

As we have mentioned, employers who choose to offer this type of leave can include certain benefits, but all the details of the agreement between the two parties must be stated in the signed employment contract.

Jury duty leave — under Mississippi law, if an employee is summoned to perform jury duty, employers must allow them to be absent from work during that time.

Moreover, the law states they cannot terminate or penalize an employee in any way for the acceptance of jury duty or force the employee to use annual, vacation, or sick leave for this matter.

Voting time leave — Mississippi employers are not legally required to offer paid or unpaid leave for the sole purpose of voting.

Military leave — this type of leave is regulated on a federal level by the Uniformed Services Employment and Reemployment Act.

The act states that all employees in the US must be granted a leave of absence to serve in one of the following:

Upon the employee's return to work, they must be entitled to the same pay increases and other benefits as if they were present at work the whole time.

Bereavement leave — employers in Mississippi are not legally required to offer any paid or unpaid bereavement leave.

Crime victim leave — if an employee in Mississippi is a victim of a crime, their employer is required to offer paid or unpaid leave.

Apart from responding to a subpoena and participating in a criminal proceeding, the leave applies to the preparation period before said proceeding.

Moreover, such employees cannot be discriminated against or treated differently upon their return to work.

Child labor laws are applicable for the employment of individuals under 18. We will use the term “minors” to refer to employees of this age category.

Let's first mention the lower threshold for employment — children under 14 years of age are not allowed to be employed in the State of Mississippi.

The primary purpose of both federal and Mississippi child labor laws is to prevent the exploitation of minors. Additionally, such laws help children prioritize education, while their employment only enhances their academic and life experience.

To be legally employed in Mississippi, children under 16 who want to work in specific industries must obtain an Employment Certificate and submit it to their employer.

This mandated document is also known as the Work Permit and applies to work in:

To acquire this certificate, the school must be contacted. The school administrator or a guidance counselor will further determine if the minor in question meets the criteria for employment. If they do, the certificate will be issued.

Apart from working in the above-mentioned positions, there are other relevant limitations in the state of Mississippi, which can be seen in the following categories:

While different rules and regulations apply to different age groups of minors, one thing still applies to all age groups — they are forbidden to work in any hazardous positions, according to federal law.

Next, let's look at some other rules stated in the Mississippi Child Labor Laws.

The state of Mississippi enforces different rules for different age groups:

There are also some restrictions on child labor in specific industries.

For example, all minors are prohibited from working with explosives and radioactive substances — we will cover the details of prohibited occupations for minors in the state of Mississippi in one of the following segments.

Let's start with some restrictions on the maximum number of work hours and night work for minors' employment.

The work hours restrictions for minors are regulated differently based on whether school is in session or not. Also, there are different nightwork restrictions based on age groups.

Here is a table of work hours for minors in Mississippi:

Age group

School IS in session

School is NOT in session

Night work restrictions

14 and 15 years of age

16 and 17 years of age

We have previously mentioned that minors are prohibited from working in hazardous positions.

Now, let's see what is considered hazardous in the state of Mississippi.

Here is the list of hazardous occupations for minors — including some that are considered so on a federal level and not just the state level:

When it comes to the hiring and selection processes of Mississippi employers, the first thing to mention is that they are prohibited from making such decisions based on discrimination.

The main discrimination reasons include the following categories:

Employees who suspect they were discriminated against should file a formal complaint, as such behavior is prohibited.

Like the majority of other states in the US, Mississippi also implements an “employment-at-will” regulation and policy.

Here is what at-will employment means for both employers and employees.

Employers in the state of Mississippi are legally required to provide a final paycheck to everyone whose employment was terminated for any reason. The paycheck must include all the wages and benefits.

However, there are no state laws and regulations regarding the due date for the final paycheck.

For this reason, federal law regulates that employers should pay their employees' final paycheck on the next scheduled payday.

Discrimination in the workplace is not only unethical but also illegal — and this is something applicable on a federal level.

Employees in Mississippi are protected from employment discrimination by the following acts:

Apart from these regulations, which are relevant on a federal level, there is an additional anti-discrimination regulation in Mississippi based on the following employee status — smoking or off-duty tobacco use.

A safe and healthy working environment is a must, and both federal and Mississippi state laws require employers to provide optimal conditions. On a federal level, this is regulated by the Occupational Safety and Health Act (OSHA), passed by Congress in 1970.

OSHA clearly states that employers are required to continually inspect for flaws and irregularities in the safety conditions and continually work on improving them.

Every employer should reduce and further try to eliminate the possibility of workplace injuries, illnesses, and fatalities.

So, what are employers required to provide to ensure adequate workplace health and safety conditions?

For starters, all employees need proper training and education immediately upon their employment.

Moreover, to comply with all the regulations, employers must conduct educational and advisory activities to ensure safe and healthy working conditions.

There is another thing employers must do to create optimal working conditions — the premises must be free from any recognized hazards that may cause harm.

Employers should regularly undertake safety demonstrations concerning health matters.

Effective safety and health requirements enforcement is under the jurisdiction of OSHA inspectors, a.k.a. compliance safety and health officers.

Their inspections can happen with or without probable cause for some of the following:

In Mississippi, the enforcement of Occupational Safety and Health Standards, both in the public and private sector workplaces, is regulated by the Mississippi Field Federal Safety and Health Councils.

Those were the most important and common categories of labor laws that apply to all or some Mississippi employees.

Here is what else is specifically regulated by the rule of law in Mississippi:

Let’s start with the first in line.

The main purpose of Mississippi whistleblower protection laws is to ensure that employees can exercise all of their legal rights without negative repercussions.

The term “whistleblower” refers to employees who have inside knowledge of illegal practices or a safety hazard in the workplace.

Whistleblowers must be able to report such instances and continue being employed.

Some of the reasons why employees cannot be discriminated against or treated differently include the following:

Moreover, under Mississippi law, a whistleblower is protected from retaliatory actions in the workplace for “blowing the whistle.” Some of these actions include:

For a whistleblower complaint to be valid, the action against the employee must be due to them reporting an issue to the governing body.

Background checks are allowed by all employers (but not required) and are subject to the federal Fair Credit Reporting Act.

This act regulates the collection, accuracy, and distribution of information in the Consumer Financial Protection Bureau — all employers must ensure they are following those requirements.

Only certain positions require background checks for Mississippi employees and applicants, so let's see which ones.

According to the Consolidated Omnibus Budget Reconciliation Act, or COBRA, employees are allowed to retain health care insurance and benefits after the termination of employment.

Federal regulations also state the law can be applied to employers with over 20 employees, and the coverage can be extended for up to 30 months.

That is the reason why many states have their version of this law, better known as the “mini-COBRA” regulation.

Mini-COBRA applies to small businesses with 2–19 employees and is enforced in Mississippi.

Therefore, the state's mini-COBRA ensures 12 months of continuation coverage if an employer has fewer than 20 employees.

Employers whose businesses operate in Mississippi follow FLSA rules and are therefore required to keep the records of all their employees for at least 3 years.

So, if you are wondering what types and categories of information such records should consist of, read on.

Here is the full list:

Some other record-keeping laws may also apply.

Here are the additional records Mississippi employers are required to keep:

To make this guide as comprehensive as possible, we have included an FAQ section where we’ll answer the most common questions about labor laws in Mississippi.

Mississippi uses both federal and state laws to regulate employment and labor. Here are some of the most important laws you must abide by in the State of Mississippi:

Employers are not required to pay their employees immediately after employment termination. They are allowed to pay the remaining wages and benefits to employees by the next scheduled payday.

Yes, employers in Mississippi are required to pay employees who work more than 40 hours per week an overtime rate of 1.5 times their regular pay rate.

Although Mississippi is an “at-will employment” state, employers can still commit wrongful termination if they terminate the employees’ contract for discriminatory reasons.

Yes, mothers in Mississippi are covered by the Family and Medical Leave Act, which allows them to take up to 12 weeks of unpaid leave for the care of a newly-born child unless they are exempt.

Clockify allows you to track time, attendance, and costs with just a few clicks — for FREE.

Your team can track work time personally via the web or mobile app, or you can set up a time clock kiosk from which employees can clock in and out.

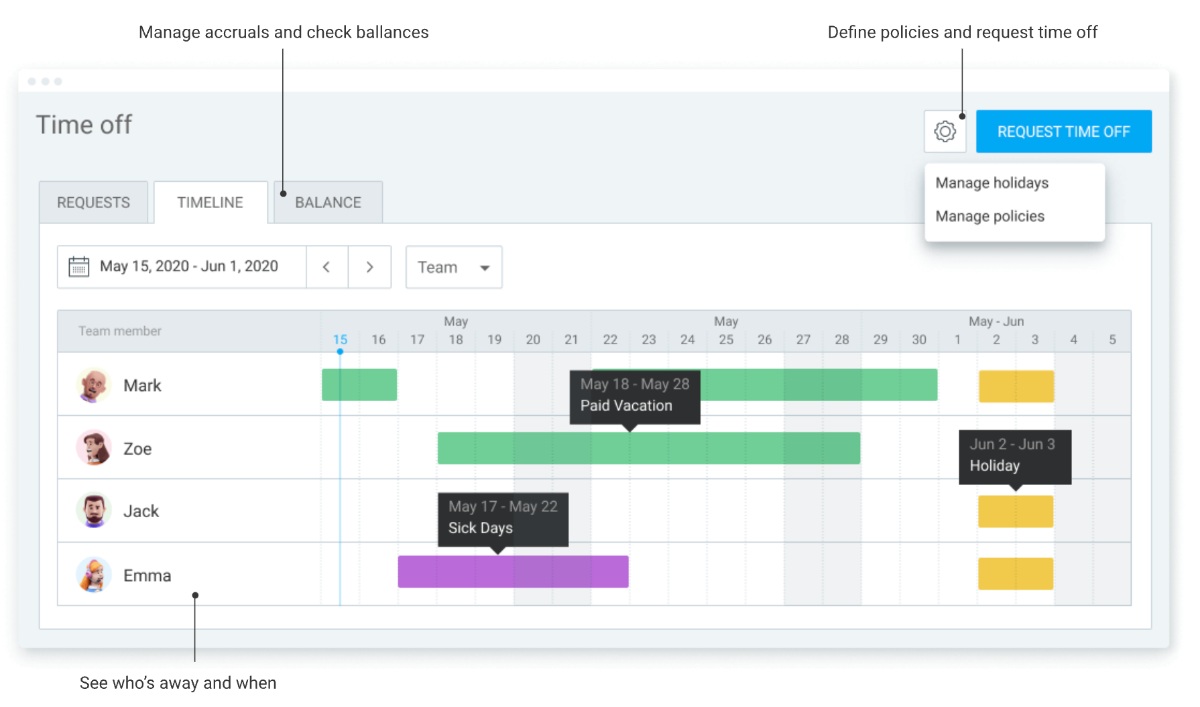

In addition, Clockify also has a Time Off feature, which your employees can use to take time off for holidays or any other type of leave.

This way, you can always know who is available and manage leave requests more easily.

Clockify Time off feature

Time-Off in Clockify

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, CSV, link, or send to QuickBooks).

We hope this Mississippi labor law guide has been helpful. We once again remind you to make sure you've paid attention to the links we've provided, as most of them will lead you to the official websites and other relevant information.

Please note that this guide was written in Q2 2022, so any changes in the labor laws that were included later than that may not be included in this Mississippi labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.