In this article, we will cover how to prepare a cash budget. Typically, cash plays a critical part in every business. Having enough cash enables a business to optimize its operation; especially it helps in the investing activities. In order to help for a business to manage its cash for both investing and financing activities, a proper cash budget is needed. So how to prepare a cash budget?

Before going in detail, let’s go through some basic definition of cash budget.

Cash budget is also known as cash forecasting. It is a statement of a business’s planned cash inflows and cash outflows for a particular period. Or simply, a cash budget shows the expected cash receipts and cash expenditures during the budget period of a business entity. Typically, the cash budget is used to estimate the short-term cash requirements for operational uses as well as to fund any investment decisions.

The cash budget is typically prepared to cover a short-period of time; usually within one year period with a breakdown to monthly or quarterly basis. The more frequencies of cash budget internal depends on how seasonal the business is. The more seasonal or uncertain position of a business leads to a more frequent the cash budget is prepared.

For a firm in which the cash flow patterns are so seasonal, the cash budget will be prepared on the monthly basis. This is because it will help such firm to see its cash position frequently and planned ahead for any funding requirements or needs for its operation.

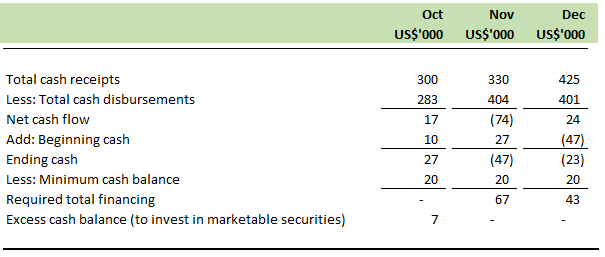

The primary purpose in preparing a cash budget is to know the cash position at the end of each month or quarter. This is because the company can decide on any financing needed if there is shortage of cash and decide on investment opportunities when the company has surplus cash.

When a company has shortage of cash or below a minimum cash balance, the company may consider enter into financing arrangements. This is typically through notes payable or obtain the overdraft facility from bank.

Alternatively, if the company have surplus or plenty of cash, the company can consider investing in any short-term marketable securities; for instance, overnight repurchase agreement or short-term negotiable certificate of deposit (CDs).

Preparing a cash budget is not an easy task. It involves various considerations including incorporating past data and a forward looking approach. There are several steps in order to prepare a good cash budget.

In the later section below, we will illustrate how to prepare a cash budget step by step.

These are as follow:

Basically, the starting point of preparing the cash budget is to do the cash receipt projections. The cash receipts include all of a business’s cash inflow of a given period.

READ: What Does Short Selling Mean?The most common components of cash receipts are cash sales, collection of credit sales which is from its accounts receivable and other cash receipts.

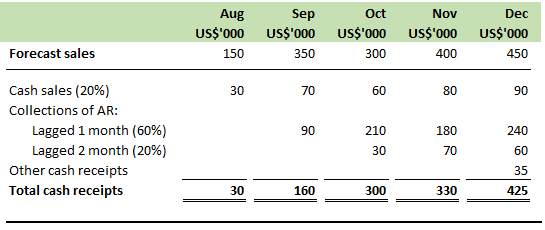

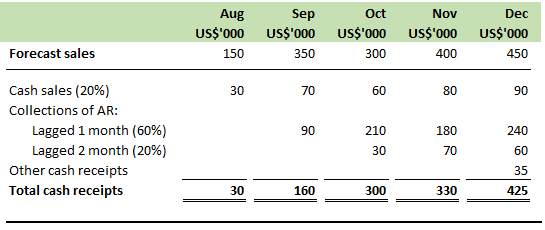

Below is the simple projection of cash receipt:

ABC Co is preparing its cash budget for the last quarter of the year from October to December 20X9. ABC Co’s actual sales for August and September 20X9 are $150,000 and $350,000 respectively. The company has projected its sales for October, November and December for $300,000, $400,000 and $450,000 respectively.

Historically, ABC Co has 20% of its sales by cash and 60% of its credit sales can be collected after 1 month with the remaining 20% collected after 2 months. For simplicity, ABC Co has ignored the bad debt in its cash budget preparation.

The forecast cash receipts will be presented as below:

Lagged 1 month: This represents the collections of accounts receivable from the sales of previous 1 month. $90,000 collections in September represents the 60% of sales for August. The collections of $210,000 in October represents the sales of $350,000 for September and so on.

Lagged 2 month: This represents the collections of accounts receivable previous 2 months. $30 represents the collections 20% of $150,000 sales of August while the collection of $70,000 represents the collections of $350,000 sales of September and so on.

Other cash receipts are usually the receipts from interest, dividend, proceed from sales of property plant and equipment etc…

Please note that depreciation and other non-cash items are not included in the cash budget. Thus, during the preparation of cash budget, please keep in mind to exclude those items.

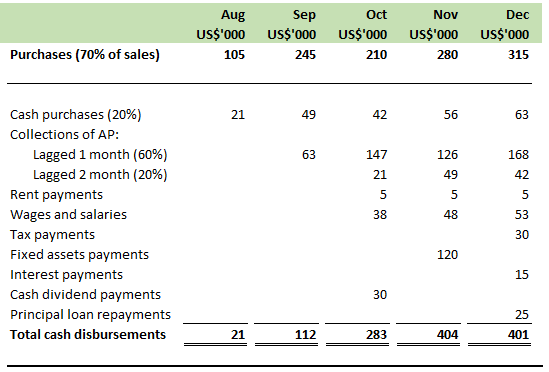

READ: What is a Put Warrant and How Does it Work?Following the cash receipts projection, let’s continue with the cash disbursements for ABC Co from October to December 20X9. From past history, ABC Co’s purchases represent 70% of sales. Historically, 20% of these is paid by cash, 60% is paid in the following month and the remaining 20% is paid in the second month of the purchases. Below are the other payments projected from October to December 20X9:

From the information above, we can prepare the cash disbursements projection as below:

Below is the summary of data given in the illustration above:

Purchases: The purchases data above came from the 70% of total sales that we illustrated in cash receipts projection above. For instance, $210,000 in October came from 70%*300,000 and so on.

Cash purchases: The cash purchases in the illustration above came from the 20% of total purchases in each month. For instance, $42,000 in October above came from 20%*210,000.

Wages and salaries: These amount came from the addition of fixed salary of $8,000 per month with the 10% of sales for each month. For instance, $38,000 in October came from (8,000 + 10%*300,000) and so on.

READ: Advantages and Limitations of Weighted Average Cost of Capital (WACC)

From step 1 and step 2 above, we can summarize the cash budget as follow:

When preparing the cash budget and in case of financing need, manager would estimate cost of financing facility to factor in the cash budget. Typically, lower interest would be considered and accounted for in the cash budget from one bank. However, they fail to account for other non-financial factors such as better customer experience or many other benefit of entering into financing arrangement with other banks.